Wealthtech platform smallcase has raised $50 million in a Series-D funding round led by Elev8 Venture Partners.

Mint first reported in December last year that the company was in talks to raise the money through a combination of primary and secondary transactions.

At the time, the company’s valuation with the new fundraising was expected to be around $300-350 million. The company declined to comment on its current valuation in response to queries sent by Mint.

The company says the fundraise has two objectives.

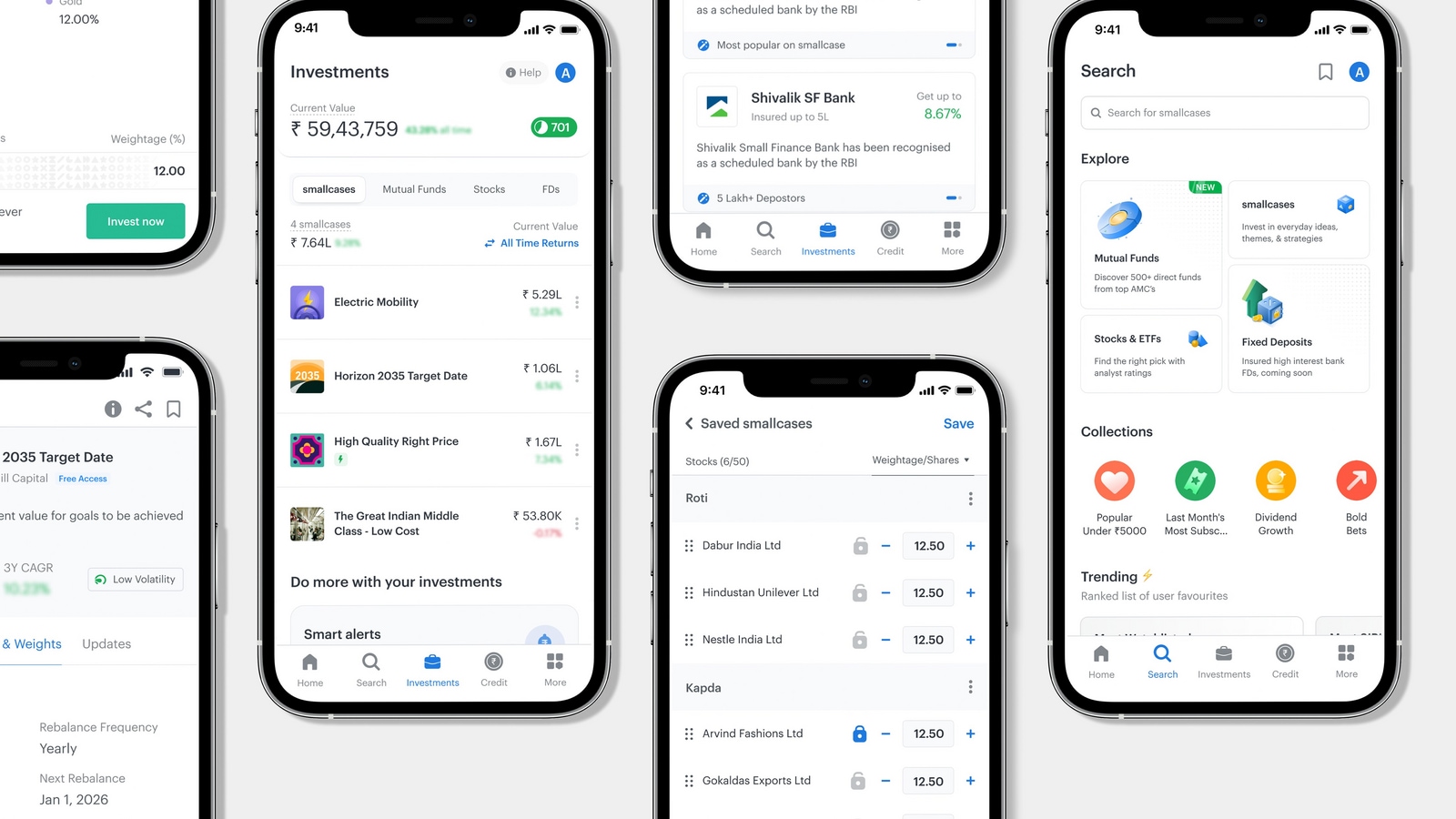

First, “Help our existing customer base allocate a larger part of their portfolios to smallcase,” according to co-founder and chief executive Vasanth Kamath. The company wants to extend its product’s form factor to more asset classes. This includes popular products like mutual funds and fixed deposits and less popular categories like global equities and bonds.

Second, smallcase wants to “enable new segments of investors to access differentiated strategies backed by professional research,” according to Kamath. To do this, the company plans to expand its partnership ecosystem and add new wealth channels and platforms.

Backing fast-growing, industry-shaping firms

“At Elev8, we believe in backing companies that are not just growing fast but are also shaping industries. Smallcase fits that vision perfectly, and we are excited to support them as they expand their offerings and reach millions more investors,” said Elev8 Venture Partners’ managing director and founding general partner Navin Honagudi.

With the Series D round, smallcase has raised around $120 million since its founding in 2015, according to startup data intelligence platform Tracxn.

The company recently entered into a joint venture with Zerodha to launch an asset management company focusing on index and exchange-traded funds. “At our AMC, we have seen an overwhelming response to our products, having scaled to 600k investors in less than 18 months. We will continue to build simple yet relevant funds that can solve various use cases and goals in our customers’ financial lives,” Kamath said.

Other investors in the funding round include State Street Global Advisors, Niveshaay AIF, Faering Capital, and Arkam Ventures. In 2021, Faering Capital led the company’s $40 million Series C round at a valuation of $200 million.

Founded by Vasanth Kamath, Anugrah Shrivastava, and Rohan Gupta, smallcase operates a model portfolios platform and boasts 10 million users. In addition to its wealthtech platform, the company works with over 250 financial institutions—from research firms to wealth managers.

Leave a Reply